Special Event Insurance to fit your budget and needs

Low Cost Special Event Insurance

|

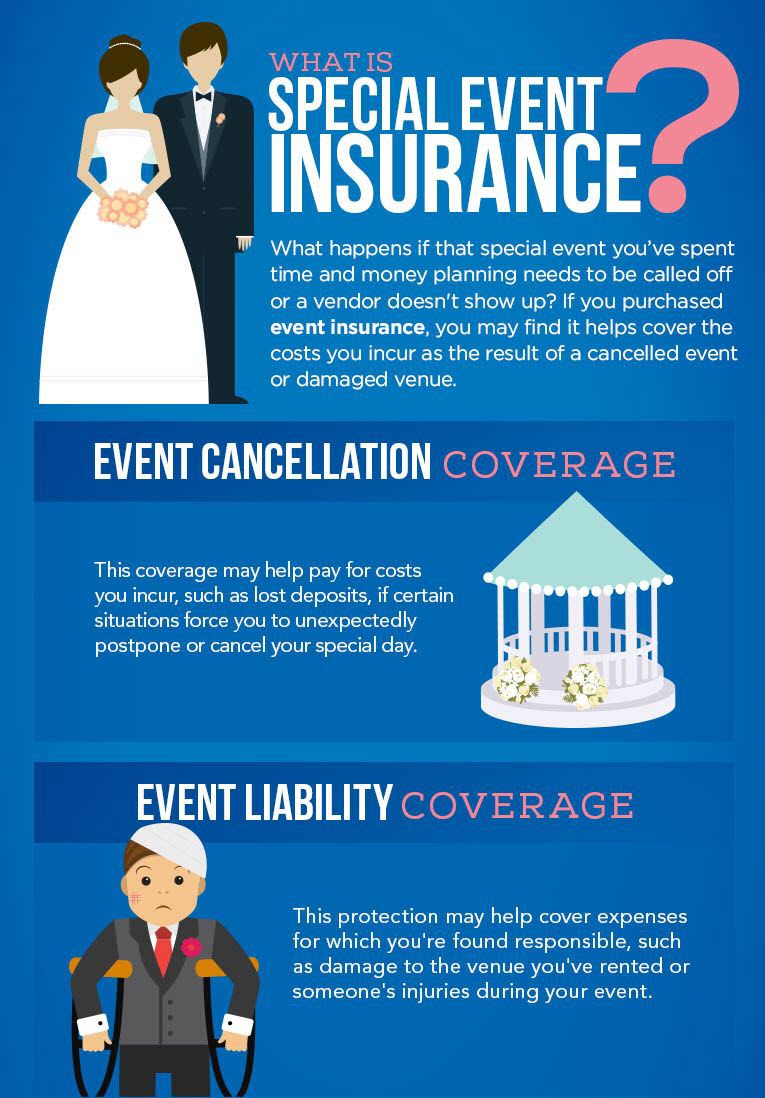

WHAT DOES SPECIAL EVENT INSURANCE COVER?

Event cancellation coverage may reimburse you for lost deposits and other fees should something unexpected force you to delay or cancel your function. If your photographer closes shop suddenly, you'll likely be covered for the cost of the lost deposit and potentially unexpected charges from having to book another photographer at the last minute. If your officiant breaks his leg the day before your wedding and you're forced to postpone, this coverage may help cover any fees associated with rescheduling the venue, caterer and other vendors. Be sure to check your policy to find out what types of situations may or may not be covered. Event liability coverage may help protect you if you're found responsible for property damage or an injury caused during your event, and many venues require you to have it. If the band you hired damages a wall with their gear, for example, this coverage may help pay for repairs. Some policies also cover incidents caused by your guests. So if someone gets a little wild on the dance floor and trips a waiter as he walks by, event liability coverage may help pay for medical expenses resulting from an injury. Again, make sure to read your policy to find out what kinds of situations it does and does not cover. WHAT EVENTS DOES SPECIAL EVENT INSURANCE COVER?Eligible events are typically private and may include functions such as:

Public events, including dance recitals, sporting events and exhibitions, typically cannot be insured under this coverage, and neither can bachelor/bachelorette parties. Certain business functions, such as fundraisers or private corporate parties, may be eligible. Your agent can tell you what specific events may qualify for coverage. OTHER INSURANCE CONSIDERATIONSKeep in mind that it's a good idea to purchase special event insurance as soon as you start making deposits or purchases for your event. There may also be restrictions on when you can purchase coverage — often no later than two weeks before your event but no sooner than two years prior. The Insurance Information Institute (III) also offers these useful tips when you're looking into insuring your special event:

|