Surety Bonds to fit your budget and needs

Low Cost Surety Bonds

|

Surety Bond vs. Insurance

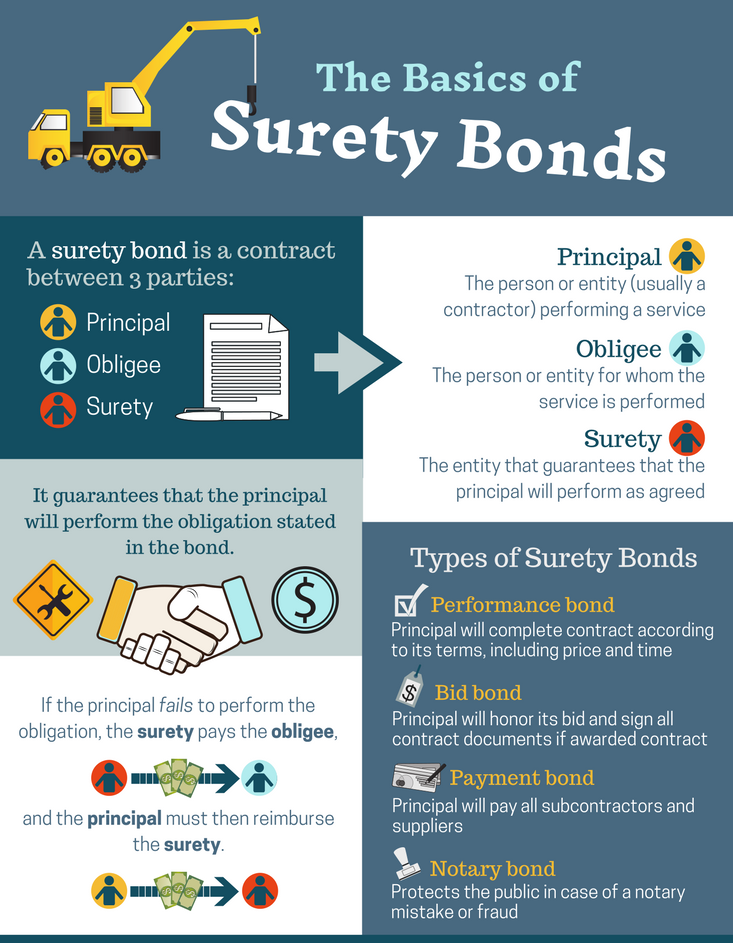

What’s the Difference? Surety bonds are an important risk mitigation tool, but it’s essential to know that insurance and surety bonds are two different types of tools. The terms “surety bond,” “surety bond insurance,” and “surety insurance” are often used interchangeably, causing some confusion for consumers. It’s important to note that surety bonds are not insurance. It’s an important distinction to make, though it can be confusing. Surety bonds are actually a form of credit. They’re mistaken for insurance because they often involve payment when things don’t go as planned. But with surety bonds, risk is always with the principal (the person purchasing the bond), not an insurance company. What does the premium cover? With most insurance policies, risk is typically spread among a pool of similar clients and policyholders contribute premiums which help cover losses. Surety bonds, however, are three-way agreements where loss is not expected. Similar to paying interest on a bank loan, premiums the premium is a fee for borrowing money, covering pre-qualification and underwriting costs, and not a means of covering losses. For example, most municipalities and governmental agencies require construction bonds on public works projects. A contractor must obtain a payment bond that guarantees subcontractors and other workers will be paid in the event the contractor defaults. The surety bond covers the municipality against financial harm, but it is not insurance. If a subcontract issues a claim against that payment bond, the contractor who purchased the bond must repay the surety for any damages paid out. The surety bond provides protection for the obligee, or the project owner. But they’re not on the hook financially for any premium costs or potential losses. In most cases, the principal, or entity whose obligations are guaranteed by a bond, will sign an indemnity agreement that stipulates he or she will repay the surety bond company if it pays out a claim. If the principal can’t actually cover the payment, compensation falls to the surety company that issued the original bond. That’s a relatively rare occurrence as surety companies rely on strict underwriting guidelines to weed out unreliable businesses. But surety bonds and insurance are two different risk-management tools. If you are looking for a surety bond, we can give you a no-obligation quote. |